After many tribulations, the day has come for SEC to finally approve the spot Bitcoin ETFs.

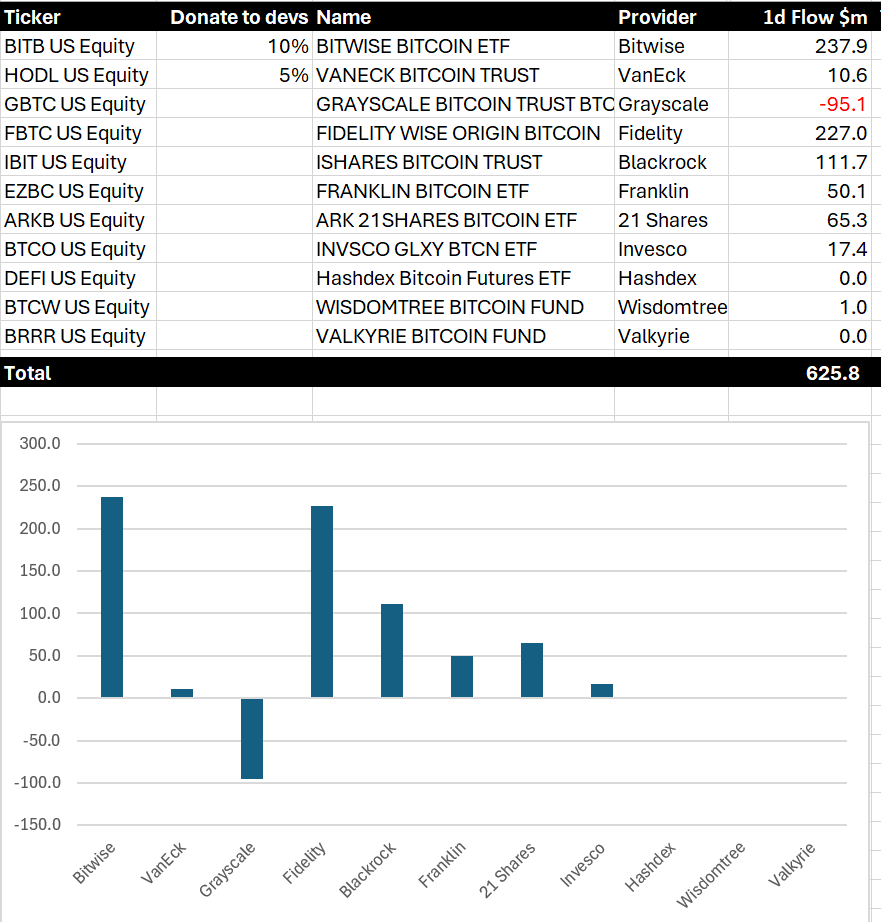

These are the 11 approved spot Bitcoin ETFs:

1. Grayscale Bitcoin Trust ETF

2. Bitwise Bitcoin ETF

3. Hashdex Bitcoin ETF

4. iShares Bitcoin ETF

5. Valkyrie Bitcoin ETF

6. ARK 21Shares ETF

7. Galaxy Bitcoin ETF

8. VanEck Bitcoin ETF

9. WisdomTree Bitcoin ETF

10. Fidelity Wise Bitcoin ETF

11. Franklin Bitcoin ETF

Statement from the official SEC website:

https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

These are the 11 approved spot Bitcoin ETFs:

1. Grayscale Bitcoin Trust ETF

2. Bitwise Bitcoin ETF

3. Hashdex Bitcoin ETF

4. iShares Bitcoin ETF

5. Valkyrie Bitcoin ETF

6. ARK 21Shares ETF

7. Galaxy Bitcoin ETF

8. VanEck Bitcoin ETF

9. WisdomTree Bitcoin ETF

10. Fidelity Wise Bitcoin ETF

11. Franklin Bitcoin ETF

Statement from the official SEC website:

https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023